The cryptocurrency industry is positioning itself as a formidable political force heading into the 2026 midterm elections, with a leading political action committee already stockpiling an unprecedented $193 million in campaign funds. This massive fundraising haul underscores the sector’s determination to shape regulatory policy and elect crypto-friendly candidates to Congress.

The staggering sum represents one of the largest pre-election war chests ever assembled by an industry-specific PAC, placing the crypto sector alongside traditional powerhouses like pharmaceuticals, energies, and finance in terms of political spending capacity. With more than a year and a half until voters head to the polls, the early fundraising success suggests 2026 could become a pivotal year for cryptocurrency’s political influence in Washington

A Strategic Response to Regulatory Uncertainty

The aggressive fundraising push comes as the cryptocurrency industry continues navigating a complex and often hostile regulatory environment. Following years of enforcement actions, proposed restrictions, and regulatory ambiguity from agencies like the Securities and Exchange Commission, crypto companies and investors have concluded that political engagement is essential to their survival and growth.

The industry learned valuable lessons from the 2024 election cycle, when crypto-focused PACs spent heavily to support candidates who pledged favorable treatment for digital assets. Those efforts yielded mixed results but demonstrated the sector’s willingness to invest substantially in political outcomes. The $193 million already raised for 2026 suggests the industry is doubling down on this strategy with even greater resources and earlier preparation.

Political observers note that this early fundraising advantage allows the PAC to begin identifying and supporting candidates well before primary campaigns heat up. This head start could prove crucial in competitive races where early endorsements and financial support can determine which candidates gain traction with voters.

Where the Money Comes From

The cryptocurrency industry’s political funding draws from diverse sources within the ecosystem. Major cryptocurrency exchanges, blockchain technology companies, venture capital firms specializing in digital assets, and individual crypto entrepreneurs have all contributed to building the massive war chest. Some of the industry’s most prominent figures, including executives from leading exchanges and founders of successful blockchain projects, have personally donated substantial sums.

This broad base of support reflects the industry’s maturation and its growing recognition that regulatory outcomes will fundamentally shape its future. Unlike earlier years when cryptocurrency was dominated by libertarian idealists skeptical of political engagement, today’s crypto industry includes major corporations with shareholders, institutional investors with fiduciary responsibilities, and established businesses with significant assets at stake.

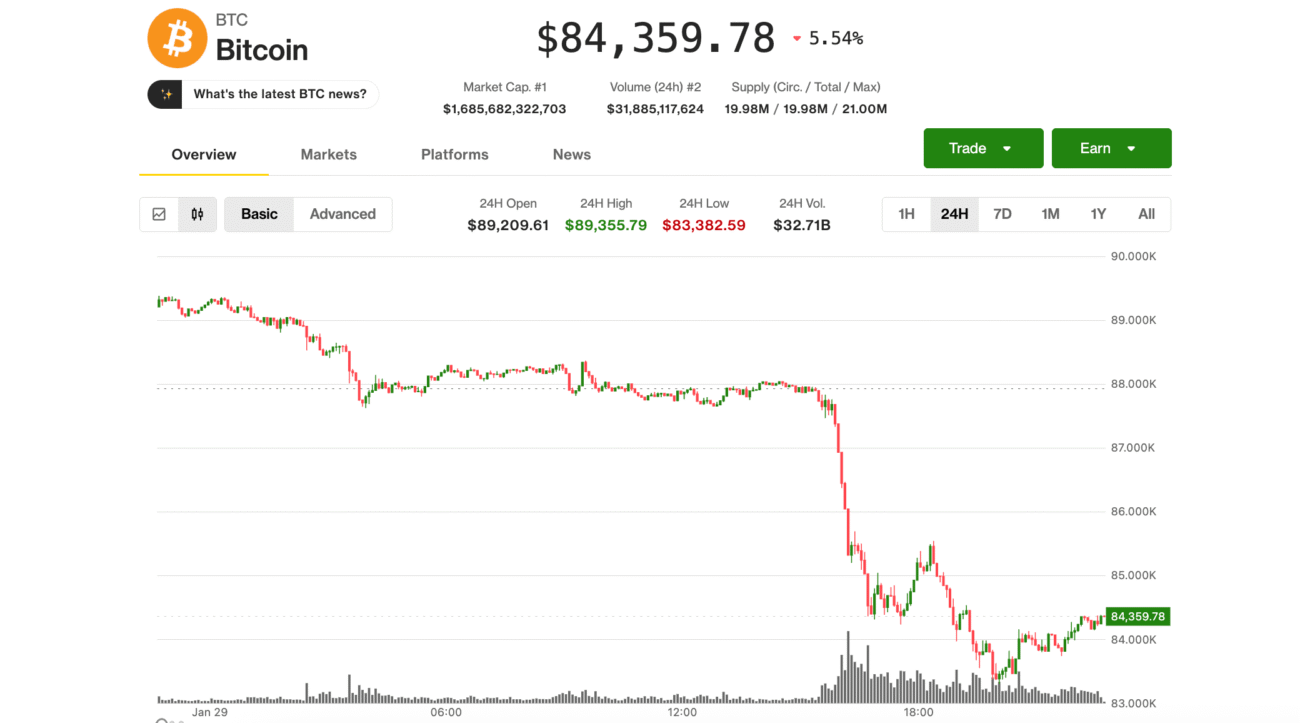

The fundraising success also demonstrates crypto’s resilience despite recent market volatility and high-profile scandals. While the industry has faced setbacks, including exchange failures and fraud cases, deep-pocketed supporters remain committed to ensuring friendly voices in Congress.

Target Races and Strategic Priorities

While specific candidate endorsements typically come closer to elections, political strategists expect the crypto PAC to focus on several types of races. Competitive House and Senate seats where candidates have staked out clear positions on cryptocurrency regulation will likely receive significant attention. Additionally, the PAC may target races where incumbents have been particularly hostile to the industry, funding primary challengers or opposing candidates.

Key committee assignments matter enormously for cryptocurrency regulation. The House Financial Services Committee and Senate Banking Committee exercise substantial oversight over agencies regulating digital assets. Seats on these committees make certain races particularly attractive targets for crypto political spending.

Beyond individual races, the PAC’s strategy likely includes supporting candidates who will champion specific legislative priorities. These might include establishing clear regulatory frameworks for digital assets, preventing overly restrictive regulations that could drive innovation offshore, protecting consumer access to cryptocurrency services, and ensuring blockchain technology can develop without excessive government interference.

Bipartisan Approach or Partisan Lean?

One crucial question surrounding the crypto PAC’s spending will be whether it maintains a genuinely bipartisan approach or leans toward one party. The cryptocurrency industry has historically prided itself on supporting candidates from both parties who demonstrate understanding and support for digital assets.

However, political realities may complicate this neutral stance. Regulatory approaches to cryptocurrency have sometimes divided along party lines, though not always predictably. Some progressive Democrats have championed strict regulation to protect consumers, while some Republicans have opposed regulation as government overreach. Yet both parties also include strong crypto supporters and determined opponents.

The PAC’s ultimate allocation of funds will reveal much about the industry’s political calculations and which party it believes offers the best path forward for favorable regulation.

Concerns About Industry Influence

The massive fundraising haul has already drawn criticism from government watchdog groups and cryptocurrency skeptics. Critics argue that allowing any industry to amass such significant political resources creates risks of regulatory capture, where government agencies end up serving industry interests rather than protecting the public.

Consumer advocacy groups have expressed particular concern that crypto political spending could undermine efforts to protect investors from fraud and market manipulation. They point to past scandals and argue that the industry seeks to avoid accountability rather than embrace reasonable oversight.

Campaign finance reform advocates see the crypto PAC’s war chest as another example of wealthy interests exercising disproportionate influence over elections and policy. They note that $193 million could overwhelm grassroots opposition and drown out concerns from ordinary voters who may be skeptical of cryptocurrency.

Looking Ahead to 2026

As the 2026 midterm elections approach, the cryptocurrency industry’s $193 million war chest positions it as a major player in American politics. Whether this investment translates into meaningful policy victories remains to be seen, but the industry has clearly decided that its future depends partly on winning political battles in Washington.

The coming months will reveal how effectively the PAC deploys its resources, which candidates it chooses to support, and whether voters prove receptive to crypto-funded political messaging. One thing is certain: cryptocurrency has arrived as a serious political force, and 2026 will test whether money can buy the industry the regulatory environment it seeks.

For candidates, the message is clear—positions on cryptocurrency regulation now carry significant political consequences, with millions of dollars in potential support or opposition hanging in the balance.