Bitcoin endures as the ultimate digital gold, defying skeptics through 2025’s brutal volatility. Prices plunged from $126,000 peaks to under $90,000, yet fundamentals scream opportunity for savvy investors worldwide. This expanded piece uncovers why now favors buyers from India to the US, blending fresh data, historical context, and timeless principles to equip readers across continents with actionable insights.

The 2025 Price Carnage Explained

The year ignited with explosive momentum following President Donald Trump’s reelection, his bold promises to position America as the “crypto capital of the planet” igniting a frenzy. Spot Bitcoin ETFs, approved earlier, saw unprecedented inflows from heavyweights like BlackRock and Fidelity, propelling prices beyond $126,000 in October—a testament to institutional hunger for the asset. This surge echoed 2024’s momentum but amplified by regulatory tailwinds and macroeconomic shifts.

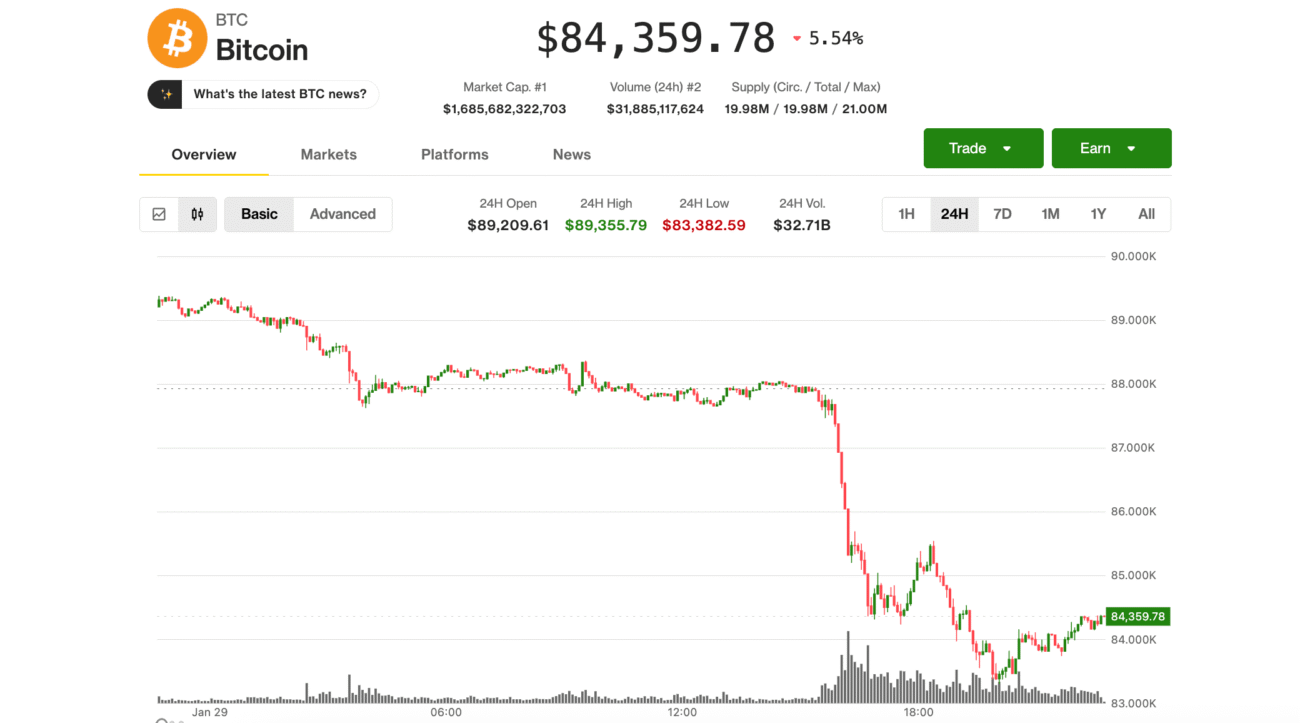

December shattered the euphoria. A sharp 5% daily plunge below $90,000 escalated into a slide toward $85,000, wiping out nearly $1 billion in leveraged positions in one brutal session. Broader market forces fueled the rout: escalating tariff threats under Trump’s administration rattled global trade, the AI investment bubble showed cracks, and anticipated Federal Reserve rate cuts stalled amid persistent inflation data. Bitcoin, often a high-beta proxy for risk assets, bore the brunt, entering what some dub a “crypto winter” phase.

This fatigue narrative paints Bitcoin toward an unusual fourth consecutive annual loss, bucking its storied Q4 strength where December historically delivers +9.7% average returns. Analysts warn of a “Darwinian shakeout,” purging overleveraged players and weak projects, much like the 2018 or 2022 bear markets that preceded monumental recoveries. For global audiences, these tremors resonate differently: in inflation-plagued emerging markets, they test resolve; in developed economies, they prompt portfolio reassessments.

Unshakable Bitcoin Fundamentals

At its core, Bitcoin remains Satoshi Nakamoto’s 2009 masterpiece—a decentralized, peer-to-peer electronic cash system built on proof-of-work blockchain technology. Capped at 21 million coins, its programmed scarcity directly counters endless fiat money printing by central banks worldwide, positioning it as “digital gold” with superior portability and divisibility. The network’s hash rate, a measure of computational security, continues to climb, safeguarding trillions in market value from quantum threats or 51% attacks.

Adoption tells a compelling story of maturation. Over 1 billion wallet addresses now hold BTC, with nations like El Salvador integrating it into their GDP as legal tender since 2021. Corporate treasuries, led by MicroStrategy’s $40 billion+ hoard under Michael Saylor, treat Bitcoin as a superior reserve asset, resilient even to 95% drawdowns. Environmental critiques fade as mining operations shift over 60% to renewable sources, from hydroelectric in Texas to geothermal in Iceland. Layer-2 solutions like the Lightning Network enable Visa-scale transactions at fractions of a penny, unlocking everyday utility.

For the global unbanked—numbering 1.7 billion—Bitcoin revolutionizes finance. Annual remittances exceed $800 billion, but traditional channels like Western Union skim 7% fees. Bitcoin slashes this to near-zero, enabling instant US dollar transfers to families in the Philippines or Mexico. In hyperinflationary zones like Venezuela or Zimbabwe, it preserves wealth where local currencies evaporate overnight.

Global Investment Perspectives

Bitcoin’s magnetic pull transcends borders, adapting to each region’s economic pulse and making this dip a tailored opportunity. In India, where a youthful demographic drives tech adoption, Bitcoin shines as a rupee hedge amid currency depreciation and remittance inflows topping $100 billion yearly—UPI-integrated exchanges make accumulation seamless, with historical December averages near +9.7% adding allure for long-term holders.

Americans, buoyed by ETF accessibility and Trump’s pro-crypto stance, witness institutional floods channeling billions monthly, positioning Q4 for 10-15% rebounds as policy clarity emerges. Brazilians combat chronic inflation spikes (peaking over 200% historically) via innovative Pix payment integrations, thriving in Bitcoin’s volatile highs that reward bold risk-takers. Nigerians, leading global P2P volumes, sidestep naira devaluations with emerging +50% growth potential, empowering entrepreneurs in Africa’s fintech boom.

Europeans, particularly Germans benefiting from tax-free holds over one year, gain MiCA regulatory clarity for steady +9% December plays, blending caution with opportunity. From Southeast Asia’s gaming economies to Latin America’s political hotspots, Bitcoin unites as a neutral, censorship-resistant asset—patient 1-5% portfolio allocations have historically crushed benchmarks, turning dips into decade-defining windfalls across these diverse landscapes.

December Rebound Signals

History whispers revival: post-halving cycles like 2021 delivered 300% December explosions from similar bottoms. Fresh liquidity from potential Fed pivots could catalyze flows, with PlanB’s stock-to-flow model signaling $100,000+ retests imminent. On-chain analytics reveal whales accumulating aggressively, not distributing—realized price around $70,000 marks capitulation floors, while ETF inflows persist despite headlines.

Even tempered forecasts from Standard Chartered retain a long-term bull thesis, eyeing $200,000 potentials as volatility tames below post-2020 oil swings. The next halving in 2028 will slash new supply further, while ETF maturation draws trillions from pensions and sovereign funds. Bitcoin’s evolution from speculative toy to store-of-value staple mirrors gold’s 1970s ascent amid fiat distrust.

Actionable Strategies Worldwide

Seize this window with precision:

- Dollar-Cost Average Religiously: Commit fixed weekly sums—India’s UPI or US bank links simplify automation, smoothing volatility over time.

- Fortify Security: Deploy hardware wallets like Ledger or Trezor; multisig setups for stacks over $10,000; shun custodial exchanges for self-custody.

- Master On-Chain Intelligence: Platforms like Glassnode track realized price ($70K support), MVRV ratios, and SOPR for entry signals; monitor ETF AUM for sentiment shifts.

- Strategic Diversification: Blend 70% BTC with ETH for smart contracts or select miners like Marathon Digital for leverage; avoid meme coins in bears.

- Navigate Taxes Proactively: India’s 30% flat gains tax demands meticulous records; US filers report via Form 1099; EU’s DAC8 eyes transactions—tools like Koinly automate compliance.

- Build Knowledge Defenses: Dive into “The Bitcoin Standard” by Saifedean Ammous or Nakamoto’s whitepaper; join global communities on X or Telegram for real-time alpha.

Bitcoin’s 2025 crucible forges enduring legends. Early adopters from 2009 pennies now command fortunes, proving cycles reward conviction. From Bihar’s content creators eyeing e-commerce synergies to Wall Street titans and Manila remitters, Bitcoin delivers financial sovereignty in a chaotic world. Tune out noise, stack sats methodically, and watch as sound money reshapes global finance. The dip is temporary; the revolution is permanent.