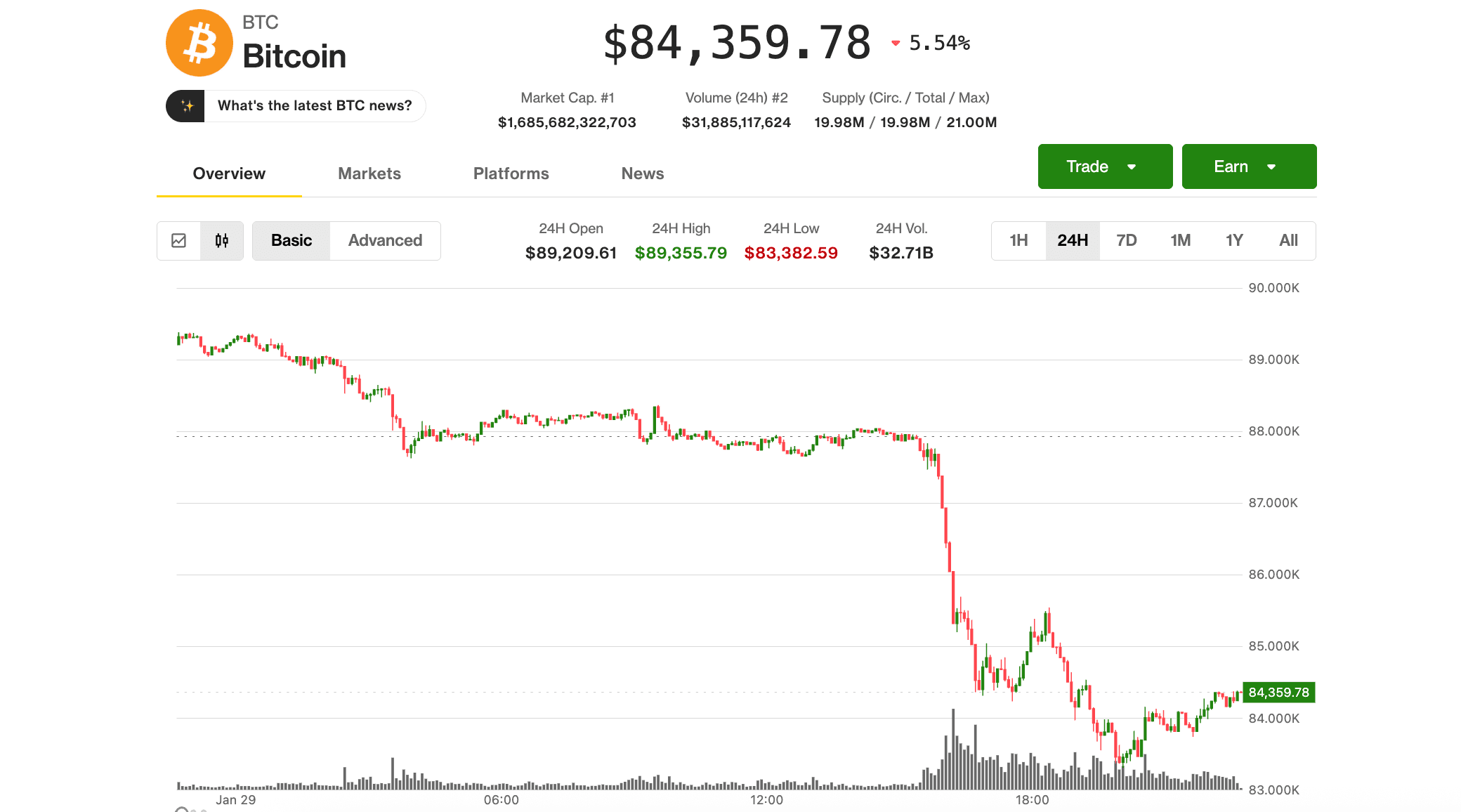

The cryptocurrency market finds itself at a critical juncture as Bitcoin treads water around the $84,000 mark, with industry experts sounding alarm bells about a potential significant correction. While the world’s leading digital asset has shown resilience at this price level, the foundation beneath it appears increasingly fragile, with analysts warning that a breach of key support levels could trigger a sharp decline to $70,000 or below.

The Current State of Play

Bitcoin’s ability to maintain its position above $84,000 represents more than just a round number on trading charts. This price point has emerged as a psychological and technical battleground where bulls and bears are locked in an intense struggle for control. The cryptocurrency has been testing this level repeatedly, each test raising questions about whether buyers have sufficient strength to defend it or if sellers will eventually overwhelm the market.

The importance of this moment cannot be overstated. After experiencing significant volatility throughout its history, Bitcoin now finds itself at a crossroads where the next major move could set the tone for months to come. Traders and investors alike are watching with bated breath, aware that the coming days or weeks could determine whether the cryptocurrency continues its upward trajectory or enters a sustained period of correction.

Understanding the $70,000 Scenario

The specific target of $70,000 isn’t arbitrary—it represents a confluence of technical factors that analysts have identified through careful market analysis. This price level corresponds to previous areas of support that have historically acted as floors during market downturns. Technical analysts point to this zone as a logical destination if the current support structure fails, representing approximately a 17% decline from current levels.

Such a correction, while painful for recent buyers, would actually fall within normal parameters for Bitcoin’s historical volatility. The cryptocurrency has experienced numerous corrections of 20% or more during previous bull markets, often using these pullbacks as opportunities to reset market sentiment and establish stronger foundations for subsequent rallies. However, this historical context provides little comfort to those holding positions at current levels.

The Technical Warning Signs

Market technicians have identified several concerning patterns in Bitcoin’s recent price action. The cryptocurrency has been forming what some analysts describe as a weakening structure, characterized by lower highs and diminishing buying momentum. Volume analysis reveals a troubling trend: rallies are occurring on decreasing volume while selloffs are seeing increased participation, suggesting that sellers are becoming more aggressive while buyers grow more tentative.

Support levels, those critical price points where buying interest has historically emerged to prevent further declines, are now being tested with increasing frequency. Each test weakens these levels, much like waves gradually eroding a beach. If these supports give way, the path to $70,000 becomes considerably more likely, as the next significant support zone doesn’t appear until that lower price range.

The relative strength index and other momentum indicators are also flashing warning signals. These tools, which measure the speed and magnitude of price movements, suggest that Bitcoin may be losing upward momentum even as it maintains current price levels. This divergence between price stability and weakening momentum often precedes significant corrections.

Macroeconomic Headwinds

Beyond technical factors, Bitcoin faces a challenging macroeconomic environment that could contribute to downward pressure. Global financial markets are navigating uncertain terrain, with central banks maintaining relatively restrictive monetary policies to combat inflation. This environment has historically been less favorable for risk assets, including cryptocurrencies, as higher interest rates make traditional safe-haven investments more attractive.

The strength of the U.S. dollar also plays a crucial role in Bitcoin’s price dynamics. When the dollar strengthens against other major currencies, it often coincides with weakness in Bitcoin and other cryptocurrencies. Recent dollar strength has created additional headwinds for digital assets, as international investors find dollar-denominated assets more expensive.

Regulatory uncertainty continues to cast a shadow over the cryptocurrency market as well. While some jurisdictions have made progress in establishing clear frameworks for digital assets, others remain in flux, creating an environment of uncertainty that can suppress institutional investment and broader market participation.

Market Sentiment and Investor Psychology

Perhaps equally important as technical and macroeconomic factors is the current state of market sentiment. Cryptocurrency markets are particularly susceptible to shifts in investor psychology, and recent weeks have seen a gradual deterioration in overall confidence. Social media sentiment analysis and other sentiment indicators suggest that fear is beginning to creep into the market, replacing the optimism that characterized earlier periods.

Long-term holders—those who have held Bitcoin through multiple market cycles—appear to be showing signs of taking profits at current levels. This is evidenced by on-chain data showing movements of coins that haven’t been active for extended periods. When experienced investors begin distributing to newer, less experienced market participants, it often signals that a market top may be approaching or has already been reached.

The Bull Case: Why $84,000 Might Hold

Despite these warning signs, it’s important to acknowledge the arguments for why Bitcoin might successfully defend current levels. The cryptocurrency has demonstrated remarkable resilience throughout its history, repeatedly confounding skeptics who predicted its demise. Institutional adoption continues to grow, with major financial institutions increasingly incorporating Bitcoin into their offerings.

The upcoming halving event, which will reduce the rate of new Bitcoin creation, historically has been followed by significant price appreciation. Bulls argue that the market is simply consolidating before the next major move higher, and that current weakness represents a buying opportunity rather than the beginning of a deeper correction.

Additionally, Bitcoin’s fundamentals remain strong. Network security continues to improve, adoption metrics are generally positive, and the infrastructure supporting the cryptocurrency ecosystem is more robust than ever. These factors provide a foundation that could support prices even in the face of technical weakness.

What Investors Should Watch

As this situation develops, several key indicators will provide clues about Bitcoin’s likely direction. Trading volume will be critical—a breakdown on high volume would be particularly bearish, while a defense of support on low volume might suggest sellers are exhausted. The behavior of other cryptocurrencies will also matter, as broad-based weakness across the crypto market would confirm that the problem extends beyond Bitcoin specifically.

Global macroeconomic developments, including central bank policy decisions and geopolitical events, could serve as catalysts that push Bitcoin in either direction. Investors would be wise to maintain awareness of these broader trends while monitoring cryptocurrency-specific factors.

Conclusion

Bitcoin’s position at $84,000 represents a moment of truth for the cryptocurrency market. While the digital asset has shown the ability to maintain this level thus far, the accumulating warning signs suggest that vigilance is warranted. Whether the market breaks down to $70,000 or successfully defends current levels will depend on a complex interplay of technical factors, macroeconomic conditions, and investor psychology. As always in cryptocurrency markets, risk management and disciplined decision-making will be essential for navigating whatever comes next.