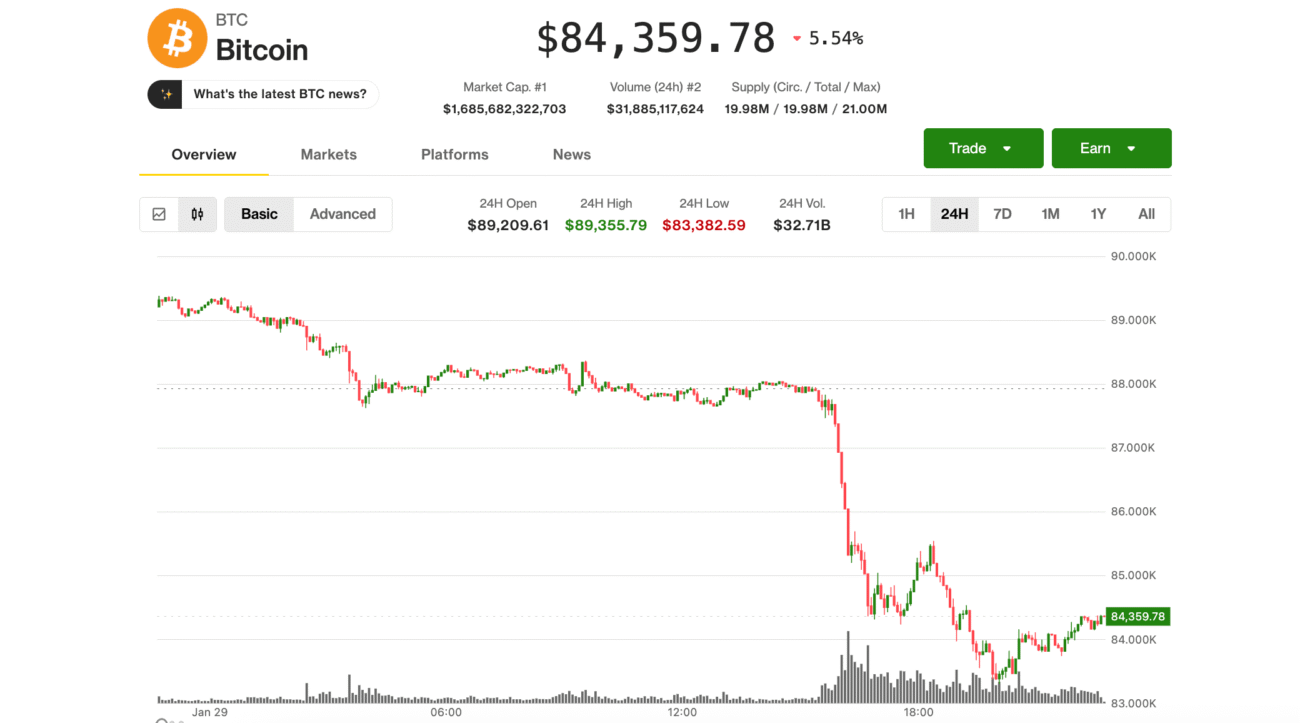

After months of steady gains, Bitcoin (BTC) has stumbled, plunging to its lowest level since June 2025. The world’s largest cryptocurrency has seen a sharp correction amid growing global risk aversion, weak investor sentiment, and concerns over monetary tightening. As prices slide, traders and analysts are debating whether this is just a temporary dip—or the start of a deeper downtrend.

What Triggered Bitcoin’s Recent Decline?

The latest sell-off in Bitcoin comes as part of a broader “risk-off” sentiment sweeping through global markets. Investors are moving away from riskier assets like crypto and tech stocks, favoring safer investments such as U.S. Treasuries and gold. Here are the main factors driving the fall:

- Macroeconomic Pressure and Strong Dollar

Recent economic data from the United States points to persistent inflation and a strong labor market, raising fears that the Federal Reserve may delay interest rate cuts. A stronger U.S. dollar typically weakens Bitcoin, as investors flock to fiat safety amid uncertainty. - ETF Outflows and Market Liquidity

After months of inflows, Bitcoin spot ETF products are now witnessing significant outflows. This indicates institutional investors may be taking profits or reallocating assets to more stable instruments. Lower ETF demand has drained liquidity from the market, amplifying price volatility. - Geopolitical and Global Market Tensions

Escalating geopolitical conflicts and unstable equity markets have also played a role. Investors often retreat to traditional assets during uncertain times, leaving crypto exposed to sudden sell-offs. The ongoing Middle East tensions and economic slowdowns in Europe and Asia have further dented confidence. - Miner Selling and Whale Movements

Data from on-chain analytics platforms show that Bitcoin miners have been offloading more BTC than usual, possibly to cover operational costs. Meanwhile, large whale wallets have seen notable outflows, signaling short-term bearishness among major holders.

How the Market Is Reacting

The drop in Bitcoin has had a ripple effect across the crypto ecosystem.

- Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) have all fallen in tandem.

- DeFi protocols and altcoins have suffered even sharper losses as traders de-risk their portfolios.

- Trading volumes on leading exchanges have spiked, indicating panic selling and profit booking.

However, some long-term investors are viewing the dip as a buying opportunity, noting that BTC still remains well above its late-2024 lows. Historical patterns suggest that Bitcoin corrections of 15–25% often precede strong recovery phases.

Is This a Correction or a Reversal?

Market analysts are divided. Some see this as a healthy correction in an otherwise bullish long-term trend, while others warn of further downside if macro conditions don’t improve.

- Bullish View: Bitcoin’s fundamentals remain strong. Institutional adoption continues to rise, and long-term holders (LTHs) have not significantly reduced their positions. Many experts believe that once inflation fears subside, Bitcoin could rebound sharply.

- Bearish View: The macroeconomic landscape remains tough. With the Fed staying hawkish and risk assets under pressure, BTC could face further declines before stabilizing.

Key Levels to Watch

Technical analysis points to several critical support and resistance zones:

- Support: $56,000 – $58,000 range (June lows)

- Major Resistance: $63,000 – $65,000 range (recent highs before the dip)

If Bitcoin fails to hold above the $56,000 mark, analysts warn it could slide toward $50,000, a level not seen since early 2025. Conversely, a bounce back above $63,000 might restore bullish momentum.

What’s Next for Crypto Investors?

For investors, this correction highlights the importance of risk management in the crypto market. Experts recommend:

- Avoid panic selling. Short-term volatility doesn’t erase long-term potential.

- Diversify portfolios. Don’t rely solely on Bitcoin—include assets like Ethereum, stablecoins, or even traditional equities.

- Monitor macro trends. Crypto remains closely tied to interest rate policies and global economic stability.

- Stay patient. Historically, Bitcoin has bounced back stronger after every major dip.

Final Thoughts

Bitcoin’s recent fall to its lowest since June underscores how interconnected global markets have become. From U.S. interest rates to global conflicts, every factor now impacts digital assets. Yet, despite the turbulence, Bitcoin’s underlying value proposition—as a decentralized, finite asset—remains intact.

Whether this downturn turns into an opportunity or a warning will depend on how investors interpret the signals ahead. For now, the message is clear: volatility is back, and only those who stay informed and strategic will thrive in the next crypto cycle.